nj ev tax credit 2020

The NJCEP offers financial incentives programs and services for New Jersey residents business owners and local governments to help them save energy money and the environment. Phil Murphy signed a bill that paved the way for an ambitious expansion of electric vehicle infrastructure in the state.

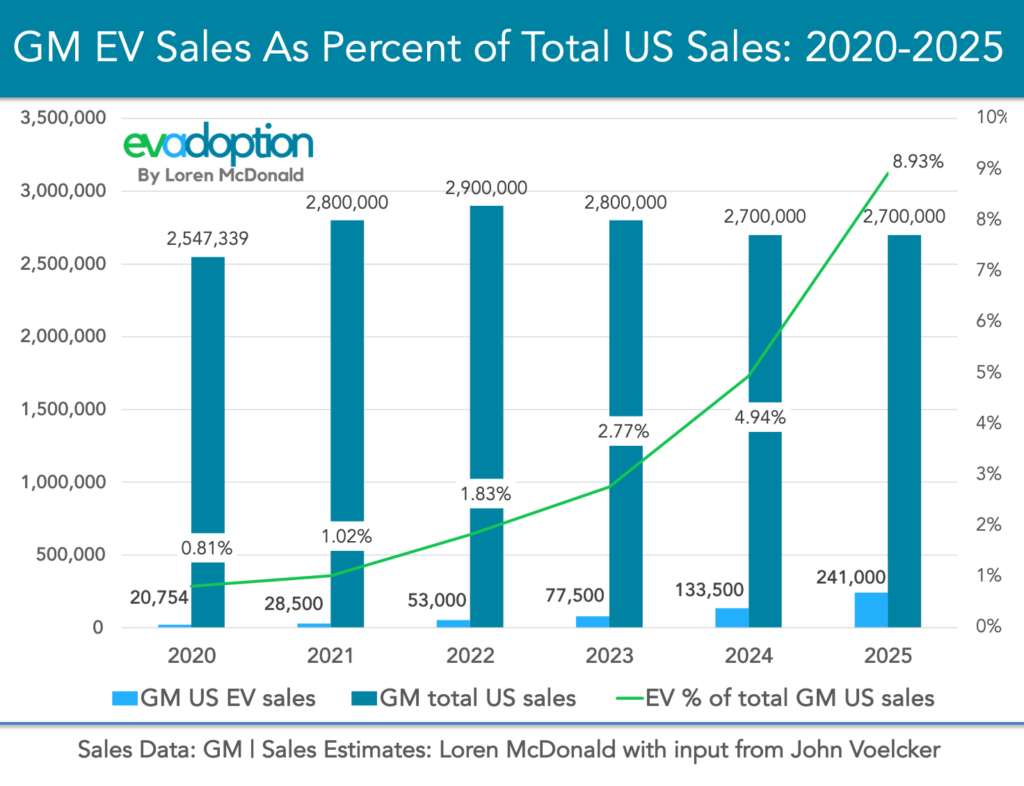

Price Parity Is Not The Key To Ev Adoption In The Us Evadoption

17 can get up to 5000 back Gov.

. Just talked to the Princeton shop. Ad Easy Software To Help You Find All the Tax Deductions You Deserve. Vermont relaunched its electric vehicle credits Nov.

The Charge Up New Jersey program is funded on an annual basis with 30 million from the Plug-In Electric Vehicle Incentive Fund which was established by the EV Act NJSA. 0 0 You Save 4366 58400 Audi 2021 e-tron sportback. Office of the Governor Governor Murphy Affirms Electric Vehicle Rebate Eligibility Effective as of January 17 2020 So if you are waiting to buy a Tesla.

Xcel Energy offers 500 Home Wiring Rebate for L2 Residential Charger. New Jerseys EV law provides the BPU with budget flexibility in its establishment of the rebate program. Highland Park NJ The electric vehicle EV registration numbers are in and they are encouraging.

Electric Vehicle EV Rebate. 2020 NJ Resident EV buyers gets 5000 in tax rebate and no sales tax. The state saw 56 growth in a year.

Between all of the different acronyms its easy to get confused. On January 17 2020 Governor Murphy signed S-2252 into law PL2019 c362 which created an incentive program for light-duty electric vehicles and at-home electric charging infrastructure. FEDERAL TAX CREDIT FOR EVSE PURCHASE AND INSTALLATION EXTENDED.

Charge Up New Jersey. The results for New Jersey are a stronger economy less pollution lower costs and reduced demand for electricity. Back in January we reported that New Jersey Governor Phil Murphy signed into law legislation that will make buying an electric vehicle in the.

Charge Up New Jersey. Jun 08 2020 at 434pm ET. On January 27 2020 Governor.

At least 30 million per year for 10 years. 4825-1 et seq and signed by Governor Murphy on January 17 2020. As in you may qualify for up to 7500 in federal tax credit for your electric vehicle.

5432B-855 The New Jersey Sales and Use Tax Act provides a sales and use tax exemption for zero emission vehicles ZEVs which are vehicles certified pursuant to the California Air Resources Board zero emission standards for the model year. Receive a federal tax credit of 30 of the cost of purchasing and installing an EV charging station. More Information provided here.

New Jersey already waives the 7 sales tax on electric vehicle purchases and the federal government offers a 2500 to 7500 income tax credit based on a cars battery capacity. The incentive may cover up to 30 of the project cost. New Jersey drivers who have purchased or leased an electric car on or since Jan.

At first glance this credit may sound like a simple flat rate but that is. Fort Collins offers a 250kW incentive up to 1000 filed on behalf of the customer. Thousands of New Jersey homeowners businesses and.

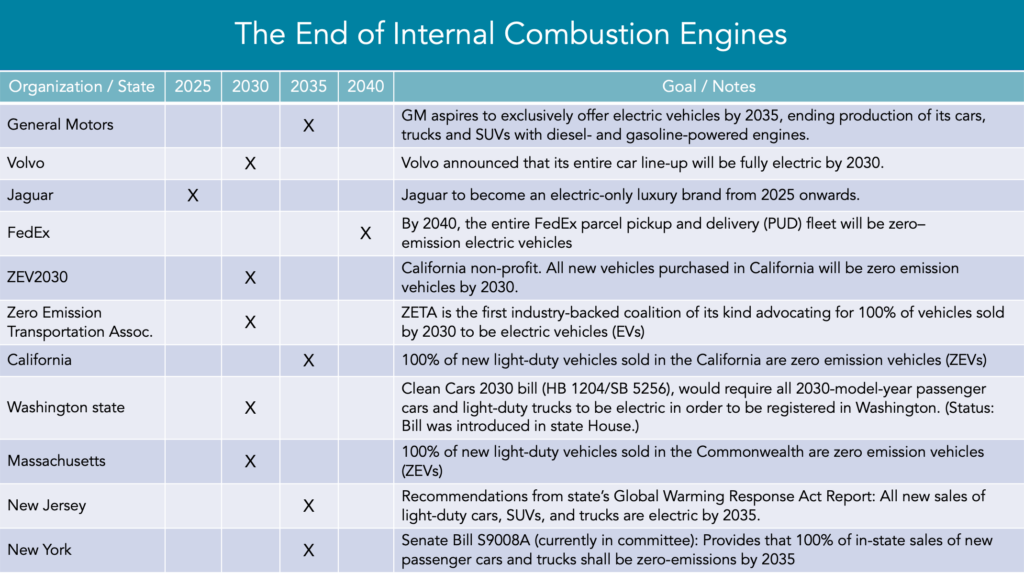

President Bidens Build Back Better bill would increase the electric car tax credit from 7500 to 12500 for qualifying vehicles however this bill has only passed and not the Senate as of April 2022. NJ PA News. For more information.

New Jersey just restarted its electric vehicle incentive program. Local and Utility Incentives. ChargEVCs analysis finds that we will need 40 million in additional funding to keep the program open through the end of the current state fiscal year June 30 2022 and stay on track to hit our goals.

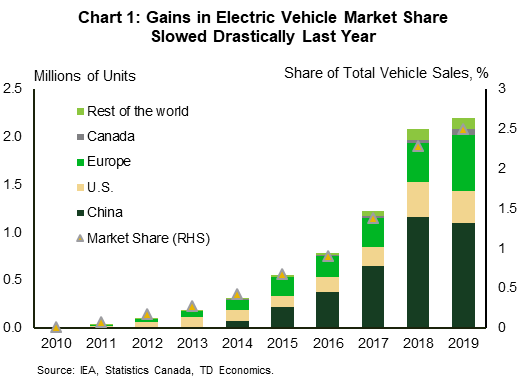

Sales of 2022 of Electric Vehicles continues go grow. In 2021 United States electric vehicle sales grew to over 430000 increasing from 2020. Federal Tax Incentive The Federal Goverment has a tax credit for installing residential EV chargers.

The 2020 30C Federal Tax Credit has been extended through 2021 which opens the door for substantial savings on EV charging. Increasing the use of electric vehicles is a critical step to secure New Jerseys clean energy future Murphy said. The New Jersey Board of Public Utilities NJBPU Charge Up New Jersey program offers point-of-sale rebates to New Jersey residents for the purchase or lease of a new light-duty EV.

0 You Save 3776 49500. 4200 0 You Save 3010 33745 BMW 2019 i3. For those not familiar with New Jerseys EV program.

With EV registrations increasing from 41097 in 2020 to 64307 at. Congress recently passed a retroactive now includes 2018 2019 2020 and through 2021 federal tax credit for those who purchased EV charging infrastructure. The rebate program covers Level 1 Level 2 and Level 3 chargers.

1 - Theres now a 5000 rebate for EVs with an MSRP under 55000. Easy Software To Help You Find All the Tax Deductions You Deserve. The incentives could be combined with a current federal tax credit to potentially bring the sticker price of a 40000 electric vehicle for example into the 28000 range.

Credits are 25 of the purchase price up to 5000 for income-eligible Vermonters purchasing or leasing a new electric vehicle so long as funding remains. Your choice to drive electric improves New Jerseys air quality and helps slow climate change. Go to Atlantic City Electric - NJ Website.

Sales Tax Exemption - Zero Emission Vehicle ZEV NJSA. Phil Murphy announced this week. File Your Taxes Today.

Here we have a basic breakdown of the main types of electric vehicles that either plug in or have no harmful tailpipe emissions. Electric Vehicles Solar and Energy Storage. The rebate is part of a push to increase plug-in vehicles on the states roads tenfold by 2025.

BMW 2020 i3 REX 168-223. 2015 2016 2017 2018 2019 2020. The Federal EV Charger Tax Credit program offers a rebate of 1000 per site.

The exemption is NOT applicable to partial. In January 2020 Gov. Audi 2021 e-tron 222.

Charge Up NJ EV Rebate NJ State Sales Tax 6625 Cost After Incentives. But when combined with the federal tax credit of up to 7500 EV drivers in the Garden State can get as much as 12500 off. In addition to Federal Tax Credit and State Sales Tax Exemptionthats a lot of savings.

Xcel Energy offers income qualified customers 5500 rebate for new and 3000 rebate for used eligible electric vehicles in lieu of state tax credit. The rebate applies to vehicles with a retail price below 55000. Of Environmental Protection allows manufacturers who sell or lease qualified LEVs to earn and.

The 30C credit covers up to 30 or 30000 of the up-front costs for purchasing and installing EV charging infrastructure and equipment for qualified properties and businesses.

Price Parity Is Not The Key To Ev Adoption In The Us Evadoption

Nj Car Sales Tax Everything You Need To Know

Governors Start 2022 With A Focus On Electric And Alternative Fuel Vehicles And Networks National Governors Association

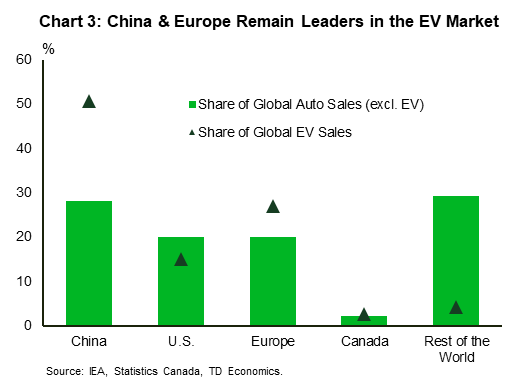

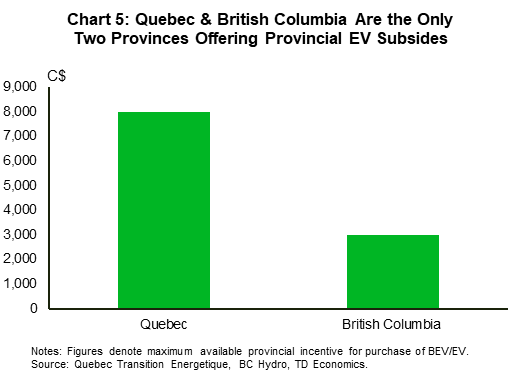

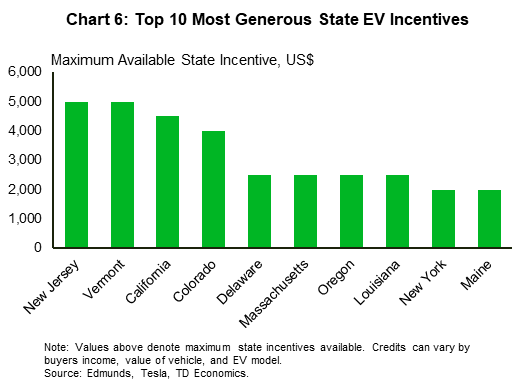

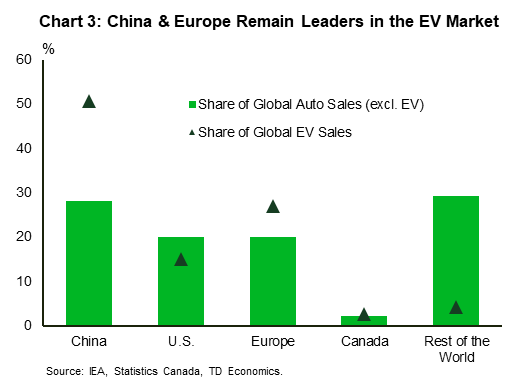

The Canada Us Electric Vehicle Market Navigating The Road Ahead

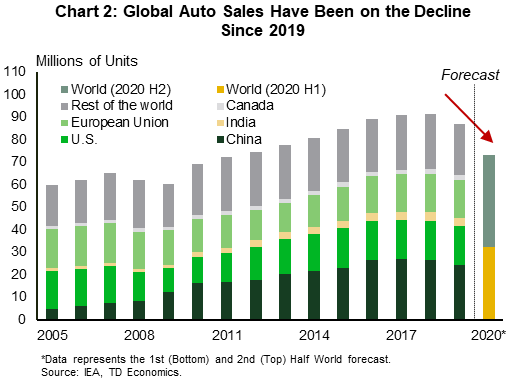

Sustainability Free Full Text Did Electric Vehicle Sales Skyrocket Due To Increased Environmental Awareness While Total Vehicle Sales Declined During Covid 19 Html

The Canada Us Electric Vehicle Market Navigating The Road Ahead

/cdn.vox-cdn.com/uploads/chorus_image/image/68514870/ahawkins_201212_4339_0011.0.jpg)

Driving The Mustang Mach E Ford S First Real Electric Car The Verge

Pre Owned Cars For Sale In Bridgewater Nj Bmw Of Bridgewater

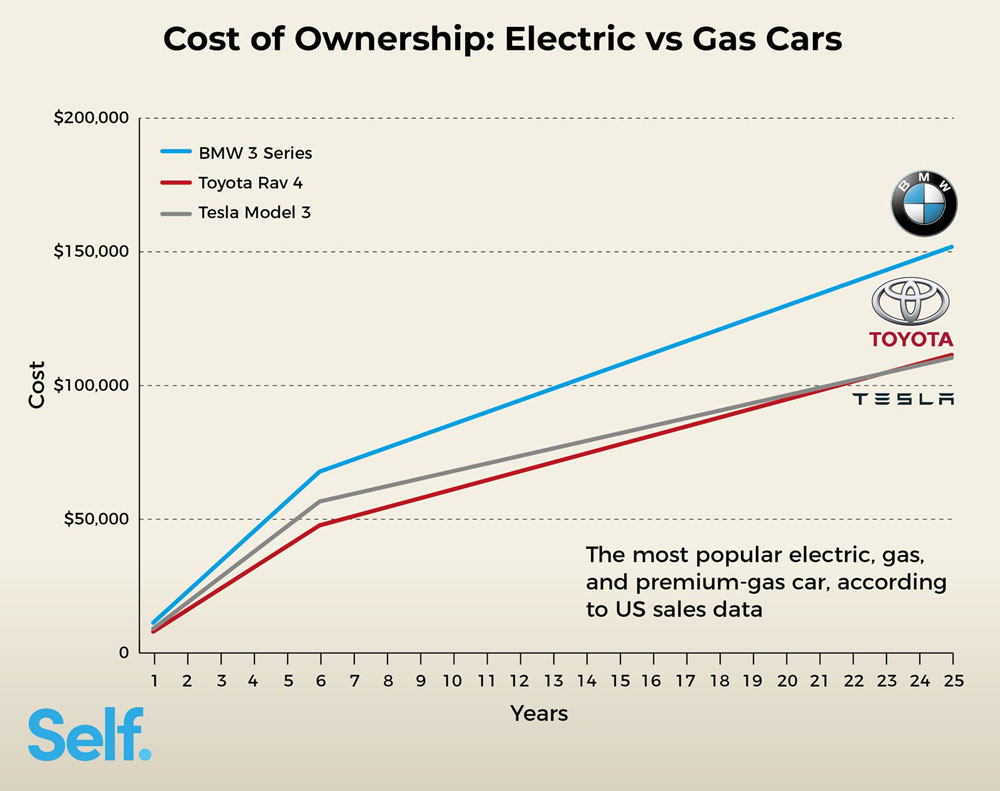

Electric Cars Vs Gas Cars Cost In Each State Self Financial

Hyundai Electric Vehicles Fred Beans Hyundai Flemington Nj

Netherlands Has New Ev Incentives 4000 Off New Ev 2000 Off Used Ev Till 2025 Cleantechnica

The Canada Us Electric Vehicle Market Navigating The Road Ahead

The Canada Us Electric Vehicle Market Navigating The Road Ahead

The Canada Us Electric Vehicle Market Navigating The Road Ahead

Tax Credit For Electric Vehicle Chargers Enel X

Sustainability Free Full Text Did Electric Vehicle Sales Skyrocket Due To Increased Environmental Awareness While Total Vehicle Sales Declined During Covid 19 Html