lakewood co sales tax online

Opry Mills Breakfast Restaurants. The PIF is not a City tax but rather a fee the.

Sales and Use Tax 2011 - Ordinance No.

. City of lakewood 480 s. There are a few ways to e-file sales tax returns. Lakewood Co Sales Tax Online.

Delivery Spanish Fork Restaurants. Essex Ct Pizza Restaurants. Consumer Use Tax 2011 - Ordinance No.

Retail Sales Tax A 35 Sales Tax is charged on all sales in the City of Englewood except groceries. The following links change the page section. There is no change to the due date for filing sales and use tax returns.

Please file your monthly sales and use tax return with the City as usual. Or you can contact the City at SalesTaxLongmontColoradogov or 303-651- 8672. Sales tax in Lakewood Colorado is currently 75.

Lakewood co sales tax online filing. If this rate has been updated locally please contact us and we will update the sales tax rate for Lakewood Colorado. Look up 2022 sales tax rates for Lakewood Pennsylvania and surrounding areas.

Lakewoods Historic Preservation Commission invites all residents to join a self-guided scavenger hunt virtually or in person during May to search for unique architectural elements and historic structures found at OKane and Washington Heights parks. The Colorado sales tax rate is currently. Manage My BusinessTax Account password required Online Payment Options.

The City of Lakewood allows qualifying 501 c 3 organizations an exemption from Lakewood sales tax when they purchase goods and services for their regular charitable functions and activities. 15 or less per month. For additional e-file options for businesses with more than one location see Using an.

Filing frequency is determined by the amount of sales tax collected monthly. Download all Colorado sales tax rates by zip code. Did South Dakota v.

Get information on Accommodations Business Occupation Motor Vehicle and Property taxes in Lakewood. If you have more than one business location you must file a separate return in Revenue Online for each location. The 2010 tax rate for Lakewood Township is 2308 for every 10000 of assessed value.

Note that in some retail areas of the City a Public Improvement Fee PIF may be charged to reimburse the developer for on-site improvements. This is the total of state county and city sales tax rates. Annual returns are due January 20.

The remainder of the. Learn more about transactions subject to Lakewood salesuse tax. Soldier For Life Fort Campbell.

The minimum combined 2022 sales tax rate for Lakewood Colorado is. Published on April 29 2022. The Belmar Business areas tax rate is 1.

To qualify for exemption an organization must complete an Application for Certificate of Exemption. Appointments are not required to visit. Tax rates are provided by Avalara and updated monthly.

The County sales tax rate is. Sales tax returns may be filed annually. The sales tax rate for Lakewood was updated for the 2020 tax year this is the current sales tax rate we are using in the Lakewood Colorado Sales Tax Comparison Calculator for 202223.

Cash payments can only be made at the Pierce Street Department of Revenue Location inside the DMV - Entrance A. The breakdown of the 100 sales tax rate is as follows. The Lakewood Washington sales tax is 990 consisting of 650 Washington state sales tax and 340 Lakewood local sales taxesThe local sales tax consists of a 340 city sales tax.

The lakewood colorado sales tax is 750 consisting of 290 colorado state sales tax and 460 lakewood local sales taxesthe local sales tax consists of a 050 county sales tax a 300 city sales tax and a 110 special district sales tax used to fund transportation districts local attractions etc. Beginning October 1 2022 all retailers will be required to apply the destination sourcing rules. DO NOT send cash through the mail.

Log in to Revenue Online. Scavenger hunt highlights Historic Preservation Month. Businesses with a sales tax liability of up to 15month or 180year.

Under 300 per month. Return and payment due on or before the 20th of the month following the end of each quarter. This exception applies only to businesses with less than 100000 in retail sales.

Governor Polis signed HB22-1027 on January 31 2022 which extends the small business exception to destination sourcing requirements. When making a cash payment be sure to bring your tax billpayment voucher. Wayfair Inc affect Colorado.

Visit the Tax Payment Options Page to verify if your tax bill can be paid in cash. To figure out the taxes on a piece of property with a total assessment of 23377808 the average assessment for a residential property in Lakewood Township in 2011 you would divide 23378808 by 100 233788 and multiply that figure by the tax rate 2. The Lakewood sales tax rate is.

Sales Use Tax. The Colorado sales tax rate is currently. Sales and Use Tax 2002 - Ordinance No.

The City of Lakewood receives 1 of the 100 sales tax rate. The County sales tax rate is. Businesses with a sales tax liability between 15-300 per month.

Returns and payment are due on the 20th of each month. Restaurants In Matthews Nc That Deliver. After you create your own User ID and Password for the income tax account you may file a return through Revenue Online.

Manage your tax account online - file and pay returns update account information and correspond with the Lakewood Revenue Division. Sales tax returns may be filed quarterly. Historic Preservation Tax 2009 - Ordinance No.

Colorados Tax-Exempt Forms. Lakewood in Colorado has a tax rate of 75 for 2022 this includes the Colorado Sales Tax Rate of 29 and Local Sales Tax Rates in Lakewood totaling 46. Businesses located in Belmar or the Marston Park and Belleview Shores districts have different sales tax rates.

Income Tax Rate Indonesia. Skip to main content. For definition purposes a sale includes the sale lease or rental of tangible personal property.

Return and payment due on or before January 20th each year. All businesses selling goods in the City must obtain a Sales and Use Tax License. Sales Tax Rates With the exception of the Belmar Business area the sales tax for Lakewood is 3.

The ST3 sales and use tax rate of 050 is effective April 1 2017 bringing the total sales and use tax rate for Sound Transit to 140. The City portion 3 must be remitted directly to the City of Lakewood. Sales and use tax Retail ecommerce manufacturing software Consumer use tax.

The Lakewood Colorado sales tax is 750 consisting of 290 Colorado state sales tax and 460 Lakewood local sales taxesThe local sales tax consists of a 050 county sales tax a 300 city sales tax and a 110 special district sales tax used to fund transportation districts local attractions etc. The tax rate for most of Lakewood is 75.

Business Licensing Tax City Of Lakewood

State Of Colorado Department Of Revenue 1881 Pierce St Lakewood Co 80214 Usa

Lakewood Colorado City Government

Sales Use Tax City Of Lakewood

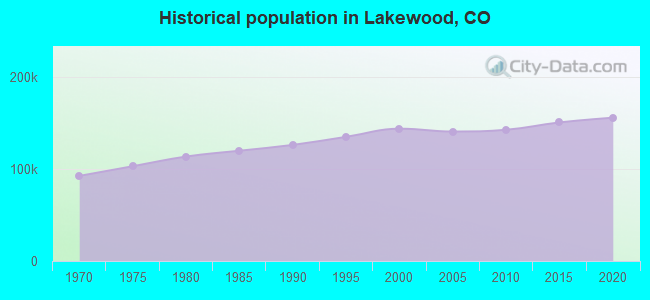

Lakewood Colorado Co 80228 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Business Licensing Tax City Of Lakewood

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation

/https://s3.amazonaws.com/lmbucket0/media/business/w-alameda-w-center-ave-275E-1-mYJ_4VpOXzVj4IghzDEIaNFaOoMwKD6YIfghSTDdSkE.a3714e1e930d.jpg)

T Mobile W Alameda W Center Ave Lakewood Co

Business Licensing Tax City Of Lakewood

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation

Automated Accounting Inc Lakewood Colorado Tax Professionals

Business Licensing Tax City Of Lakewood

Lakewood Co Social Security Office 13151 W Alameda Pkwy 80228

/https://s3.amazonaws.com/lmbucket0/media/business/alameda-wadsworth-7900-1-UCMN_iO0Jfual44MkjPveIZm9NauPHzTSkh4XcJrIn4.1781e296339c.jpg)

T Mobile Alameda Wadsworth Lakewood Co

How Colorado Taxes Work Auto Dealers Dealr Tax

Business Licensing Tax City Of Lakewood

Business Licensing Tax City Of Lakewood

City Of Lakewood Income Tax Fill Online Printable Fillable Blank Pdffiller